| What is contingent in real estate? A contingency clause is a text that can be added to an agreement to purchase that outlines certain conditions that must be met for the sale of the property to go through. |

It’s important that you carefully examine any conditions in an offer.

This article will describe typical contingencies in a purchase agreement and explain what they mean to you and the sale of your home.

TipWe recommend that you work with a real-estate agent to navigate contract negotiations and contingencies. Managing legal matters without the help of an attorney or agent can be dangerous.

4 Real Estate Contingencies to Know

1. Financing Contingencies

Most real estate purchase agreements include a financing contingency. The contingency allows buyers to cancel the contract without penalty in case they are unable to secure a mortgage. In most purchase agreements, the buyer is given 45-50 days to obtain a loan. In most cases, the contingency also includes details on the financing such as the type of loan, the amount paid in down payment, loan term, and interest rate.

Some buyers choose to remove the financing condition, which can be a big risk for them if they cannot obtain financing. In a hot market, a buyer may do this to demonstrate their confidence to a seller who is considering multiple offers. If the financing does not work out, then the buyer will lose any earnest money that they have put down.

What it means to sellers

This is not a cause for concern, as it is common in many loans. Make sure that the number of days a buyer has to get a loan is within the normal range, which is 45-60.

3. Appraisal Contingencies

Appraisal Contingency are included in many real estate contracts when the buyer relies on bank financing for the purchase of the home. A lender will order an appraisal to make sure that the home is appraised at the same value as the loan requested or less. The lender may refuse to finance a home purchase if the appraised value is not high enough.

What it means to sellers

This contingency usually isn’t a problem. If your appraisal is low, it could result in the buyer’s mortgage being denied. You can request a second opinion if you believe there has been an error. You can also re-negotiate with the buyer the price of the sale to arrive at a price which values the property below or equal to the loan amount. The buyer can cancel the contract if you do not take these steps.

3. Home Inspection Contingencies

This clause protects the buyer from damage that could affect the value. The clause gives the buyer time to inspect the property and cancel the contract if they are not satisfied. The buyer can bring in as many inspectors, contractors and exterminators to inspect the home during this period.

What it means to sellers

When the inspection shows that the house needs to be repaired, further negotiations are often held to determine how the repairs will paid for as well as who is responsible for making sure they are completed.

4. Home Sale Contingencies

If the buyer is relying on her home’s sale to buy yours, she may add a contingency. This contingency can be used in two different ways.

Situation #1: The buyer makes an offer to buy your house, but they haven’t yet received an offer for their house.

If you accept an offer, your house will appear on the MLS under “under contract”, meaning that it has already been accepted pending the completion of the home sale condition. The “under contract” status will likely turn off many potential buyers. You can still market your home, accept offers and continue accepting them. You can accept another offer if you wish, but your original buyer has a certain amount of time to fulfill their contingency. This is defined in the contract. You can move on with your new buyer if they don’t.

Situation #2: The home is already under contract and the buyer has made an offer.

You would then stop marketing your house and wait until the closing of the buyer’s property. The contingency will not be met if the buyer’s home does not close within the time period specified in the contract. You can then market your home again and accept new offers.

What it means to sellers

In both cases, the time frame and risk are usually longer. We recommend that sellers avoid working with buyers who have included a contingency for a home purchase in their offer. Your sale shouldn’t be stalled before closing.

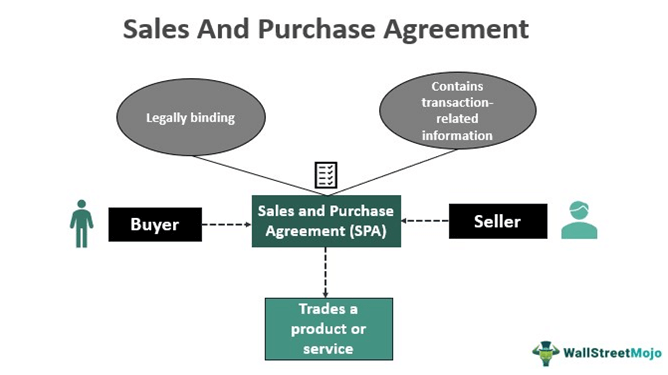

A real estate agreement is a legally binding contract. If you are unsure of the legal implications of certain contingencies , seek legal advice prior to signing the agreement.

+ There are no comments

Add yours